September 2, 2025

Maina Susan is a Tax & Finance Writer at Quartet Solutions, simplifying tax regulations and financial concepts to help businesses stay compliant.

LinkedIn >>Getting a KRA Tax Compliance Certificate (TCC) in Kenya doesn’t have to be confusing.

Whether you’re an SME owner, NGO manager, corporate executive, or job seeker, this 2025 step-by-step guide by Quartet Consulting breaks everything down in simple, clear steps – with screenshots included to make the process even easier.

Table of Contents:

1. What is a KRA Tax Compliance Certificate in Kenya?

2. Why Do You Need a KRA Tax Compliance Certificate in 2025?

3. Who Needs a KRA Tax Compliance Certificate in Kenya?

4. Requirements for a KRA Tax Compliance Certificate in Kenya

5. How to Apply for a KRA Tax Compliance Certificate in Kenya – Step by Step

6. How to Reapply After Your KRA Tax Compliance Certificate Expires

7. Common Questions About the KRA Tax Compliance Certificate in Kenya

8. Pro Tips to Avoid Your Tax Compliance Certificate Application Being Rejected

10. Disclaimer

A KRA Tax Compliance Certificate (TCC) is an official document issued by the Kenya Revenue Authority (KRA) to prove that you have:

Think of it as your tax clearance report card in Kenya.

Don’t risk rejection because of compliance issues.

Quartet Consulting can help you stay TCC-readyHere’s why having a valid KRA Tax Compliance Certificate in Kenya matters:

Basically, if you have a KRA PIN, you should stay compliant. This includes:

Before applying, make sure you:

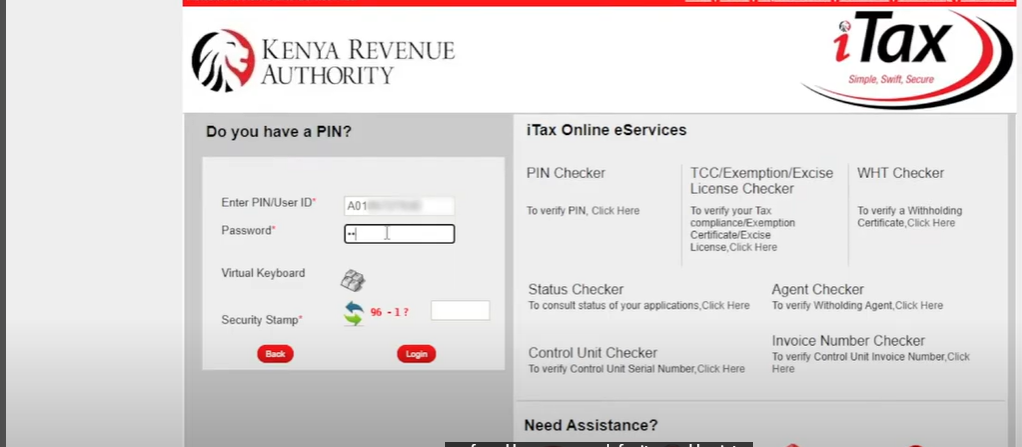

Step 1: Log into iTax

Step 2: Go to “Certificates”

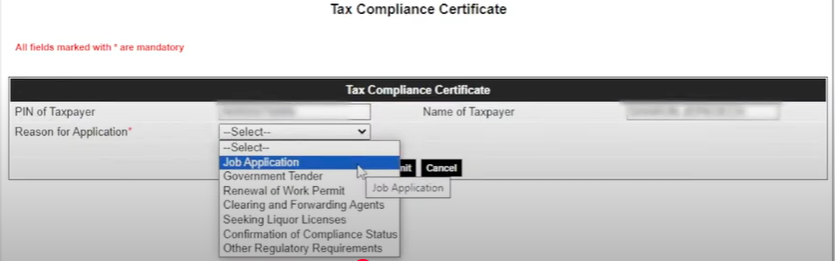

Step 3: Fill in the Form

Step 4: Submit

Step 5: Wait for Feedback

Step 6: Download Your Certificate

It happens more often than you think.

We’ll fix your returns, penalties, or iTax errors – fast.

Get My Application SortedA KRA Tax Compliance Certificate is only valid for 12 months.

Once it expires, you’ll need to reapply to keep using it for jobs, tenders, or licenses.

The good news? Reapplying is exactly the same process as applying for the first time:

As long as you’ve filed all returns and cleared any taxes or penalties, your new certificate will be auto-approved instantly.

Q: Is it free to get a KRA Tax Compliance Certificate in Kenya in 2025?

Yes! Applying for a Tax Compliance Certificate through the KRA iTax portal is completely free. You don’t need to pay any agent or third party unless you’d like professional help with the process.

Q: How long does approval take?

Q: How long is a KRA Tax Compliance Certificate valid in Kenya?

A TCC is valid for 12 months from the date of approval. After it expires, you’ll need to reapply, but only if you’ve remained tax compliant throughout the year.

Q: Can I check if my TCC is genuine or still valid?

Absolutely. You can quickly verify the validity of a KRA Tax Compliance Certificate using the KRA M-Service App or directly on the iTax portal. This is especially useful for employers, government tender committees, and NGOs that want to confirm authenticity.

Q: Why is my TCC not being approved?

This often happens if you haven’t filed all your returns or cleared penalties. Check out our step-by-step guide on filing your taxes in Kenya to stay compliant and avoid rejection.

Learn how to file your tax returns in Kenya step by step

Following these simple steps will save you time, stress, and unnecessary back-and-forth with KRA.

Your KRA Tax Compliance Certificate in Kenya is more than a piece of paper – it’s your pass to jobs, tenders, licenses, and business opportunities.

At Quartet Consulting, we help SMEs, NGOs, and corporates stay tax compliant and get TCCs approved without stress.

Do you need help with your TCC application or other tax issues?

Talk to Quartet Consulting Today – Your First Consultation is Absolutely Free.

Why struggle alone?

Talk to Quartet Consulting today – Free First Consultation.

This 2025 KRA Tax Compliance Certificate guide is for general information only. It should not be taken as legal or tax advice. For personalized support with your taxes or compliance needs in Kenya, please contact Quartet Consulting.